Affordable AC & Heating Systems in Wisconsin!

Serving Burnett County & Polk County, Wisconsin

Having more than 30 years of experience, we have successfully provided excellent indoor comfort in homes and commercial buildings throughout surrounding areas of Siren Wisconsin.

Contact the experts at Earth Energy Today!

715-349-2314

Earth Energy Systems Reviews From Our Clients:

Enhance Hydronic Heating System with a Mitsi Ductless System

Mitsubishi Electric and How It Works

Your Siren, Wisconsin Heating And Cooling Source

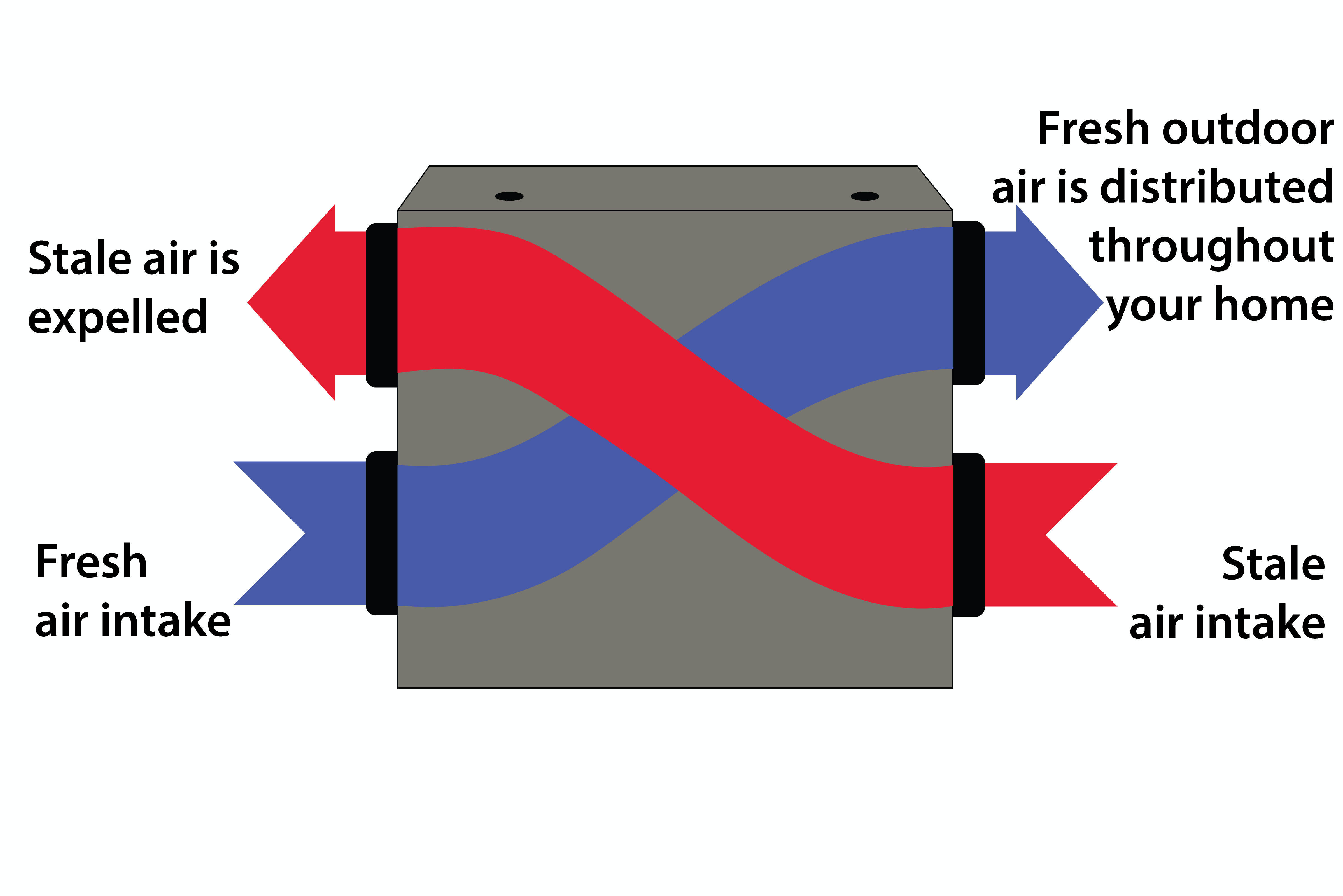

Based in Siren, Wisconsin, Earth Energy Systems is the best heating and air conditioning service company, serving as a trusted supplier of a wide range of affordable heating and cooling systems. We provide heating solutions to Wisconsin at affordable rates, as well as air conditioning repair services for commercial and residential clients. Our company offers furnaces, geothermal systems, geothermal heat pumps, garage heaters, air conditioners, air filtration systems, thermostats, and more. We are recognized as the best heating and air conditioning service company in the region.

We also offer air conditioning service and repair services for a variety of affordable heating and cooling products. With over 30 years of experience, we have successfully provided excellent indoor comfort in homes and commercial buildings throughout the surrounding areas of Wisconsin.

The experts at Earth Energy are known for providing air conditioning service intelligent solutions to ensure that your HVAC equipment operates efficiently and smoothly. Our organization employs seasoned professionals who are trained to handle all your best heating and air conditioning systems projects. Whether you need an affordable heating company for your house or a centralized cooling system for the office, you can rest assured that with Earth Energy's assistance, you are sure to get affordable heating and air conditioning solutions.

Both residential and commercial customers can take advantage of our affordable AC systems, air conditioners, heating systems (from energy-efficient brands like Mitsubishi, Electric, and Trane.)

As a leading Air Conditioning Service and HVAC solutions provider, we also offer WaterFurnance geothermal systems with a water system siren, wi. The products targeted for residential and commercial industries boast robust features, ensuring your comfort without breaking the bank.

Earth Energy Systems specializes in heating and cooling in Wisconsin. We understand that HVAC systems are a substantial investment. We offer systems by first analyzing your needs. We focus on the goal of providing customers with the best affordable heating and cooling systems in Wisconsin. We are also available to keep your HVAC systems operating for a long time.

Looking for affordable AC systems and need air conditioning service for a new home or are you looking to replace your old system? You can rely on Earth Energy Systems for expert service. We are dedicated to serving our customer's heating and cooling needs in the most affordable and efficient way. Our experts are available round the clock to provide you the best heating and cooling systems. No matter what your need, we will install, repair, and maintain your HVAC system.